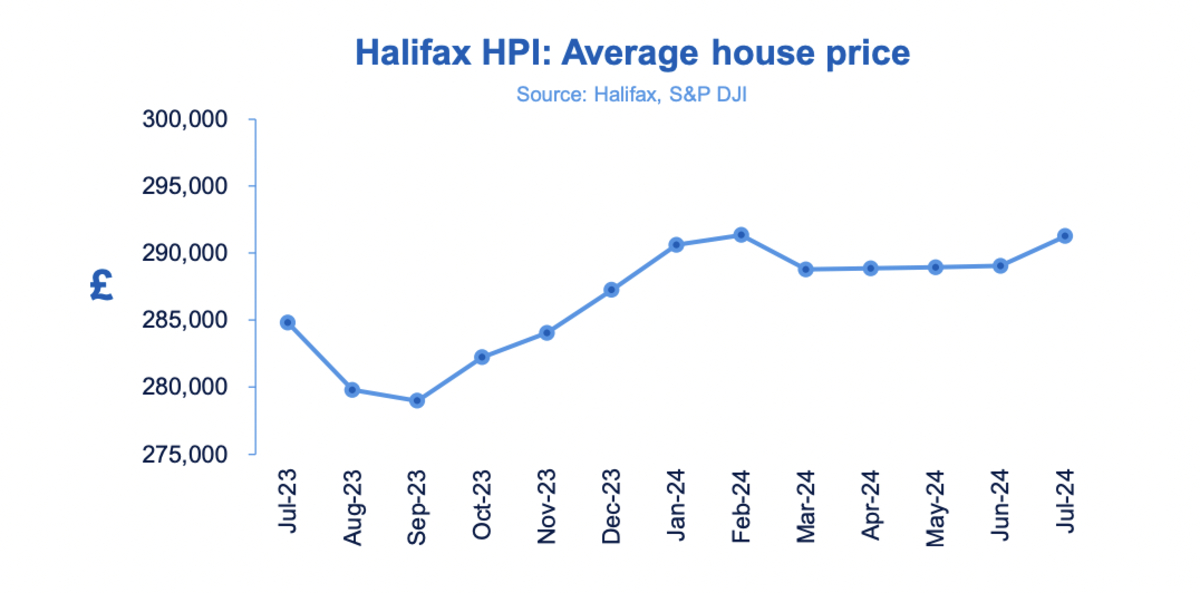

House prices in the U.K. recorded the biggest yearly increase since January, rising 2.3 percent annually and 0.8 percent monthly in July, according to the latest data from mortgage lender Halifax.

The Halifax July house price index reveals that the average U.K. house price reached 291,268 pounds, up from 289,042 pounds in June. Notably, Northern Ireland continues to record the strongest annual house price growth in the U.K.

“Last week’s Bank of England’s base rate cut, which follows recent reductions in mortgage rates, is encouraging for those looking to remortgage, purchase a first home or move along the housing ladder. However, affordability constraints and the lack of available properties continue to pose challenges for prospective homeowners,” stated Amanda Bryden, head of mortgages, Halifax.

Regional increases

Northern Ireland continues to record the strongest house price growth of any nation or region in the U.K., rising by 5.8 percent annually in July, up from a 4.1 percent rise the previous month and the highest increase since February 2023. The average price of a property in Northern Ireland is now 195,681 pounds.

House prices in the North West also recorded strong growth, up 4.1 percent annually to 232,489 pounds. In Wales, house prices grew 3.4 percent to 221,102 pounds, the highest since October 2022. Meanwhile, Scotland saw a 2.1 percent rise in house prices to 205,264 pounds.

The only region or nation to record a fall across the U.K. was Eastern England. Properties now average 330,282 pounds, down 0.4 percent annually.

Notably, London continues to have the most expensive house prices in the U.K., now averaging at 536,052 pounds, up 1.2 percent compared to last year.

Read: India eases new real estate tax rules following criticism

Property transactions decline

HMRC monthly property transaction data reveals that U.K. home sales decreased by 0.6 percent in June 2024 to 91,370. Quarterly seasonally adjusted transactions, however, rose 7.3 percent.

The latest Bank of England figures show the number of mortgages approved to finance house purchases decreased slightly in June 2024 by 0.3 percent to 59,976. Year-on-year, the figure was 11.7 percent above June 2023.

For more news on real estate, click here.