Skip to main content

Skip to footer

The main drivers of the CPI increase were the rising costs of shelter (up 0.4 percent) and gasoline (up 2.8 percent)

U.S. consumer prices increased less than expected in April, which supported bullion

Inflation remains the most important concern when operating a small business in the U.S.

Decline in inflation indicators could bode well for the precious metal

Import prices in yen increased 6.4 percent annually in April and 1.4 percent compared to March

Stagflationary risks in the U.S. continue to support gold prices

U.S. employment data supported gold prices, which rose over 2 percent by the end of last week

Potential shocks to agriculture, global food prices and oil production remain a risk to Nigeria's growth

Softer U.S. jobless claims data contributed to the optimism surrounding gold

Hotter-than-expected U.S. inflation data could potentially drive gold prices down

Unemployment to steadily increase to 4.7 percent by 2025 as U.K. labor market cools

Economic expansion in Germany, Spain and Ireland propelled eurozone's economic growth

Market expectations for any rate cuts have been pushed out, which could boost the U.S. dollar and potentially dampen oil demand and prices

Gold could capitalize on potential downturns in U.S. macroeconomic data in the coming quarters

The central bank has kept interest rates at 5.25 to 5.50 percent since July 2023

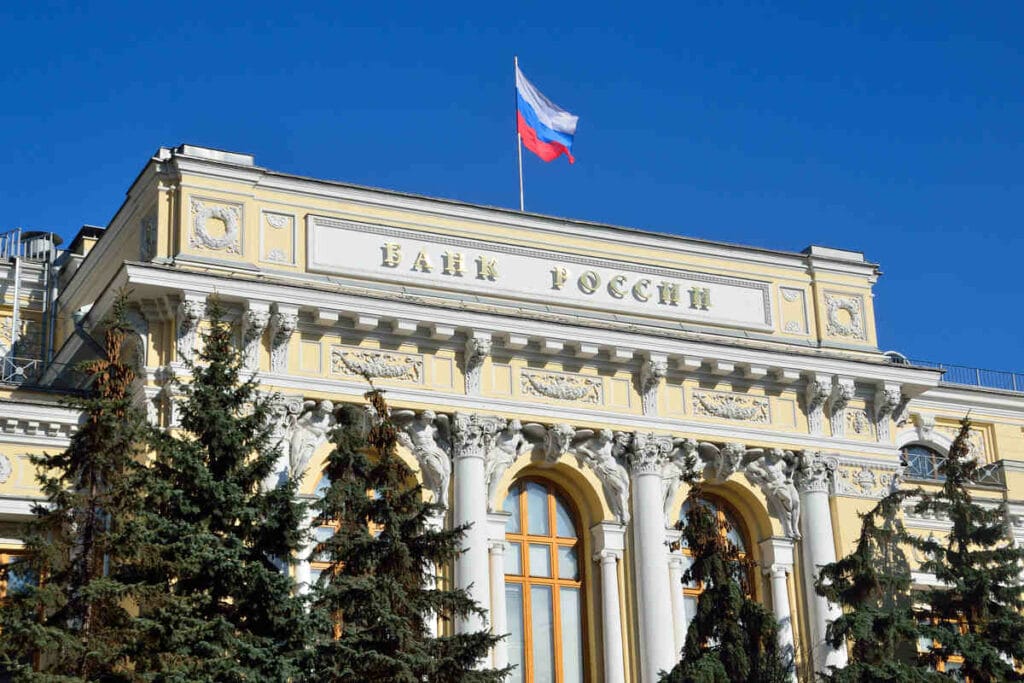

The central bank raised inflation forecast to 4.3-4.8 percent, up from 4-4.5 percent

This data supports the ECB's plan to start cutting eurozone interest rates in June after inflation falls slightly above its 2 percent target

Despite the increase, gold prices were down around 2.3 percent, their biggest weekly drop since early December

Recent attempts by Japanese authorities to intervene in currency markets have been ineffective

Decline in government spending contributes to moderation in U.S. economic activity

U.S. labor market supports growth with job gains averaging 276,000 per month in Q1 of 2024

Tourism boosts country’s economy, but lower exports and consumption weigh on growth

Food prices remained unchanged at 5 percent in March compared to February

Officials highlighted that the ECB's decisions hinge on incoming data, especially regarding wages, profits, and productivity