The contribution of international tourism and the travel and tourism sector to the global gross domestic product (GDP) is expected to return to pre-pandemic levels this year. As more countries lift COVID-19 travel restrictions, demand for travel is strong, states the new World Economic Forum (WEF) travel and tourism study.

The WEF reveals that the countries with the highest recovery rates include the United States, Spain, Japan, France and Australia. Regionally, the Middle East saw the highest rate of recovery in international tourist arrivals, recording a 20 percent increase above the 2019 level. Meanwhile, Europe, Africa and the Americas all saw a strong recovery of around 90 percent in 2023.

“This year marks a turning point for the travel and tourism sector, which we know has the capacity to unlock growth and serve communities through economic and social transformation,” said Francisco Betti, head of the global industries team at the WEF.

Recovery remains mixed

The WEF’s Travel & Tourism Development Index 2024 (TTDI), in collaboration with the University of Surrey, highlights key global trends in the tourism sector.

The WEF attributes the recovery of the global tourism sector to multiple factors, including:

- Significant increase in demand worldwide

- More available flights

- Better international openness

- Rising interest and investment in natural and cultural attractions

However, this global recovery is not even across all regions. Hence, 71 of the 119 economies on the index saw an increase in their scores since 2019. Moreover, the average index score is only 0.7 percent above pre-pandemic levels.

Although the global tourism sector is recovering, it continues to face several challenges including growing macroeconomic, geopolitical and environmental risks. Moreover, the sector is facing rising scrutiny of its sustainability practices and the impact of new digital technologies, such as big data and artificial intelligence.

Besides, labor shortages are persistent while air route capacity, capital investment and productivity have not been able to keep up with the surge in demand. This supply-demand imbalance, fuelled by global inflation, has increased prices and service challenges.

TTDI’s top 30 economies

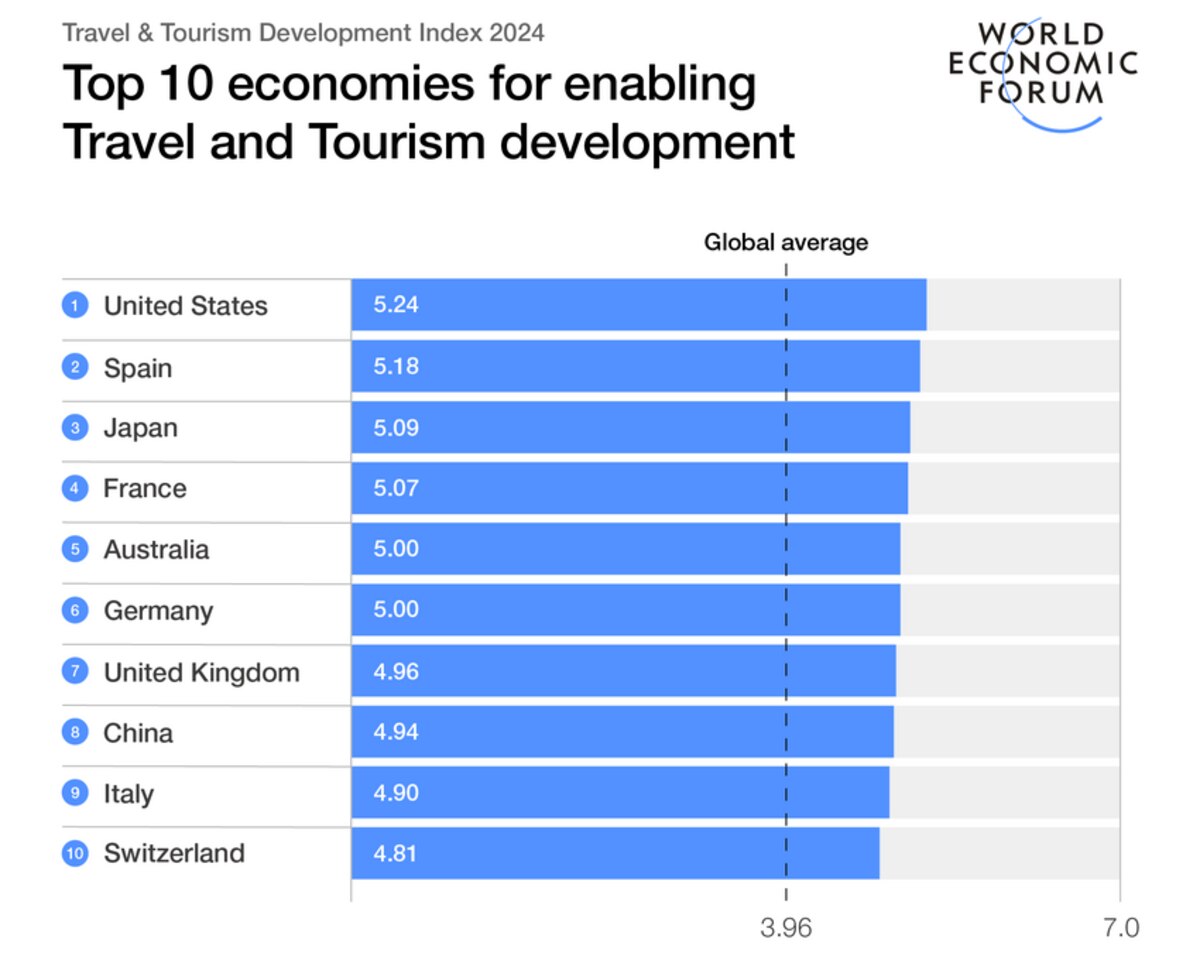

The top 30 economies on the travel and tourism development index include 26 high-income economies, 19 of which are in Europe and seven are in Asia-Pacific. Three economies are in the Americas while only one (the UAE) is in the Middle East and North Africa region (MENA). The top 10 countries in the 2024 edition are the United States, Spain, Japan, France, Australia, Germany, the United Kingdom, China, Italy and Switzerland.

Despite high-income economies leading growth, developing countries have also seen significant improvement across their tourism sector. China, in particular, has positioned itself among the top 10 on the index. Meanwhile, Indonesia, Brazil and Türkiye have joined the top 25.

Generally speaking, low- to upper-middle-income economies account for over 70 percent of countries that have improved their scores since 2019. Meanwhile, MENA and sub-Saharan Africa are among the regions that saw the greatest improvement. In the MENA region, Saudi Arabia and the UAE are the only high-income economies to rank among the top 10 most improved economies between 2019 and 2024.

Bridging the gap

Despite the strides in recovery, the TTDI believes that the global tourism sector requires significant investments to close the gaps between developing and high-income countries. In particular, leveraging natural and cultural assets can offer developing economies an opportunity for tourism-led economic development.

“It’s essential to bridge the divide between differing economies’ ability to build a strong environment for their travel and tourism sector to thrive,” said Iis Tussyadiah, professor and head of the School of Hospitality and Tourism Management at the University of Surrey.