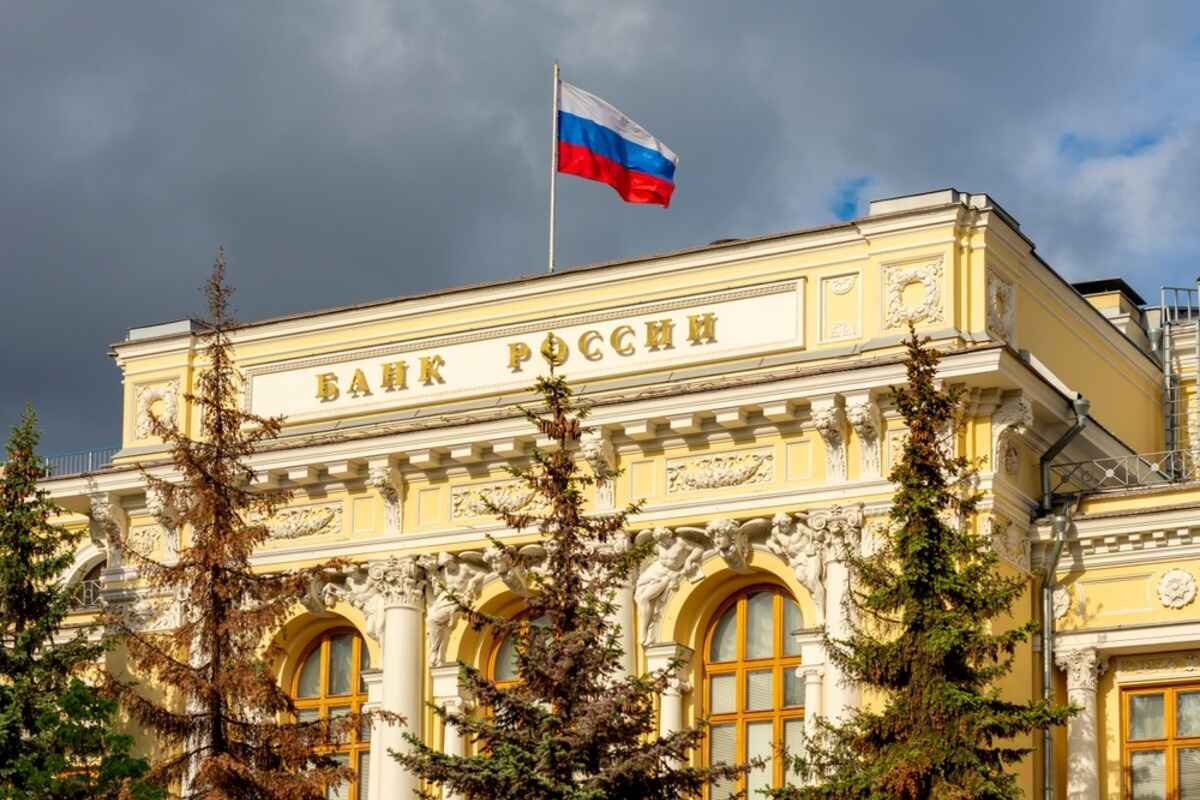

The Russian central bank increased its key interest rate by 1 percentage point to 19 percent on Friday, due to persistent high inflation and robust domestic demand. This figure is just shy of the record high of 20 percent that was recorded immediately after Russia’s full-scale invasion of Ukraine.

This adjustment represents the second consecutive hike following a period from late 2023 to the end of July 2024, during which the rate was maintained at 16 percent.

As noted in the Central Bank of Russia’s (CBR) statement, annual inflation in the country is currently at 9 percent, surpassing earlier predictions. Although the economy is beginning to show signs of slowing, domestic demand continues to significantly outpace supply, and the labor market remains tight.

Read more: Russia’s foreign exchange reserves surge to $603.7 billion in May 2024

The CBR indicated that current inflationary pressures remain elevated and projected that by the end of 2024, annual inflation would likely surpass the July forecast range of 6.5-7.0 percent. Additionally, the statement highlighted that growth in domestic demand is significantly outpacing the capacity to expand the supply of goods and services.

Consequently, the bank indicated that further tightening of monetary policy would be necessary to assist the government in reaching its inflation target of 4 percent. While recognizing that inflation is expected to exceed previous forecasts for 2024, the bank still anticipated a decline to between 4 and 4.5 percent in 2025, moving closer to the target rate.

This latest rate increase marks the sixth adjustment in over a year. The Central Bank last raised interest rates in July, lifting the key rate from 16 percent to 18 percent.

For more economy news, click here.