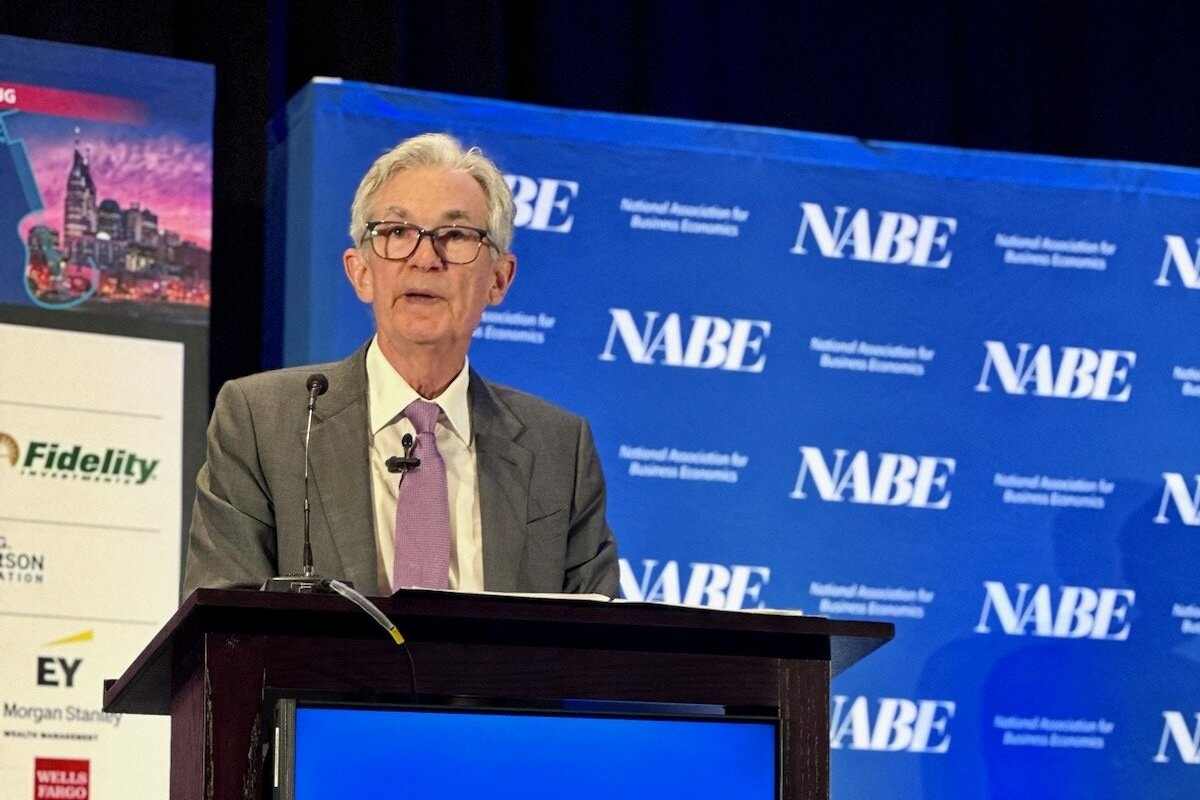

During his speech at the National Association for Business Economics Annual Meeting, Federal Reserve chair Jerome Powell noted that monetary policy “will move over time toward a more neutral stance” if the economy evolves broadly as expected.

Powell also stated that the U.S. central bank is not on any preset course when it comes to interest rate cuts, acknowledging that economic risks are two-sided. “As we consider additional policy adjustments, we will carefully assess incoming data, the evolving outlook, and the balance of risks,” he stated.

Labor market recovers

In its latest meeting, the Federal Reserve cut interest rates by 50 basis points, reflecting the growing confidence in the country’s economy and declining inflation. “Many indicators show the labor market is solid,” noted Powell.

The U.S. unemployment rate is well within the range of estimates of its natural rate and layoffs are low. Real wages are also increasing at a solid pace, broadly in line with gains in productivity.

Despite the recent recovery, labor market conditions have clearly cooled over the past year. “Workers now view jobs as somewhat less available than they were in 2019,” the Fed chair added.

The moderation in job growth and the increase in labor supply have led the unemployment rate to increase to 4.2 percent, still low by historical standards. “We do not believe that we need to see further cooling in labor market conditions to achieve 2 percent inflation,” Powell added.

Read: Swiss National Bank lowers interest rate to 1.0 percent as inflation falls

Inflation inches closer to 2 percent target

Powell explained that in the last 12 months, headline and core inflation in the U.S. were 2.2 percent and 2.7 percent, respectively. Disinflation has been broad-based, and recent data indicates further progress toward the 2 percent target.

“Broader economic conditions also set the table for further disinflation. The labor market is now roughly in balance. Longer-run inflation expectations remain well anchored,” stated Powell.

Jerome Powell added that the central bank has continued to see solid growth and healthy gains in the labor force and productivity. The Fed chair reiterated the central bank’s commitment to restoring price stability without a rise in unemployment that has frequently accompanied efforts to bring down high inflation.

“Our policy rate had been at a two-decade high since the July 2023 meeting. In the 14 months since, inflation has moved down, and unemployment has moved up, in both cases significantly. It was time for a recalibration of our policy stance to reflect progress toward our goals as well as the changed balance of risks.” Jerome Powell added.

For more economy news, click here.