China’s Semiconductor Manufacturing International Corp (SMIC) recently announced a 21.8 percent year-on-year rise in revenues to $1.90 billion. However, the top chipmaker reported a significant decline in profits during the second quarter of 2024 amid a domestic price war and technological rivalry between Beijing and Washington targeting SMIC particularly.

In a statement to the Hong Kong Stock Exchange, the Chinese chipmaker said that its second-quarter profit attributable to owners stood at $164.6 million, down 59.1 percent annually. Still, SMIC said it expected revenue growth to continue in Q3, increasing by 13 to 15 percent from the second quarter.

SMIC shares rose 4.94 percent to HKD16.58 as of 11:16 GMT amid a broad market rally, which lifted the benchmark Hang Seng Index (HSI) by 1.17 percent.

Read: Meta raises $10.5 billion in debt offering to supercharge AI investments, outpace competition

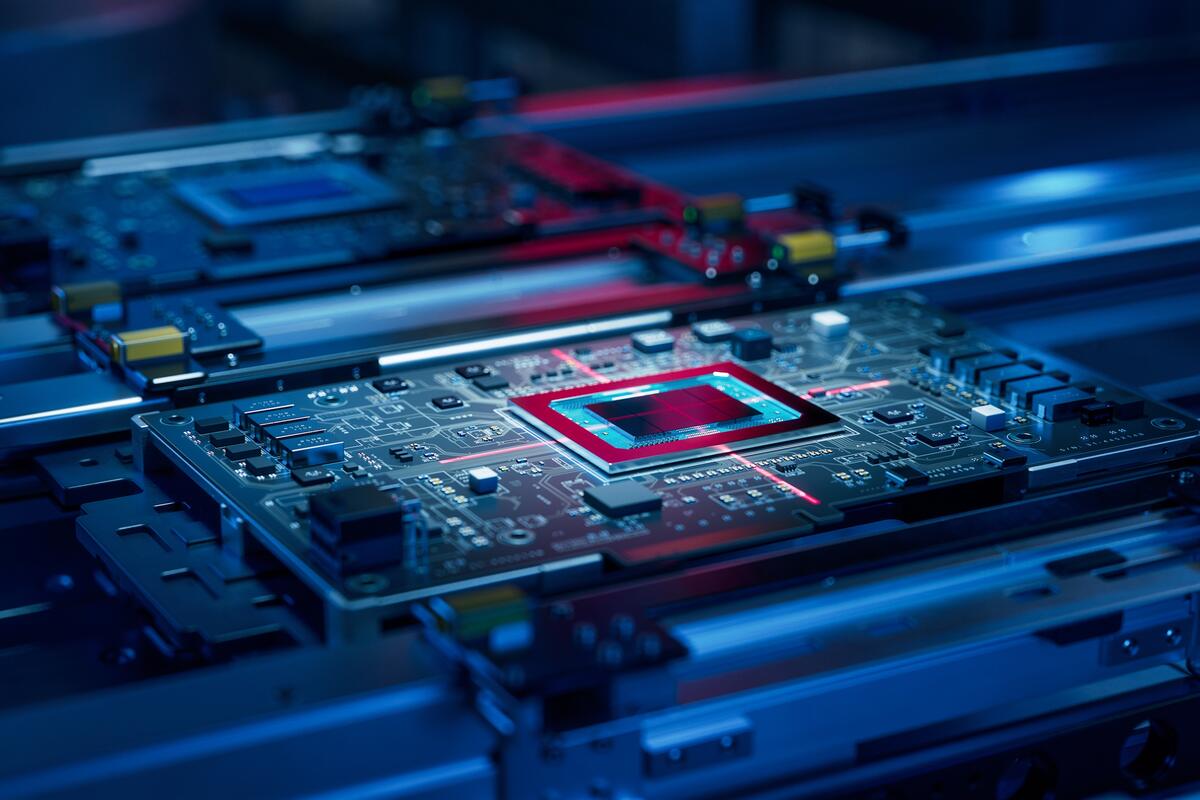

While SMIC primarily produces basic chips for less sophisticated electronics, it gained attention after a Huawei smartphone teardown revealed an SMIC-made chip among the most advanced produced in China. However, advanced chip production remains limited, constraining SMIC’s ability to fully benefit from the artificial intelligence boom driving growth for some rivals.

Industry leader Taiwan Semiconductor Manufacturing Co (TSMC) reported a 30 percent rise in second-quarter revenue, largely attributed to strong demand for advanced chips in AI and high-performance computing. On Friday, the TSMC shares rose 4.24 percent to TWD934.

For more news on technology, click here.