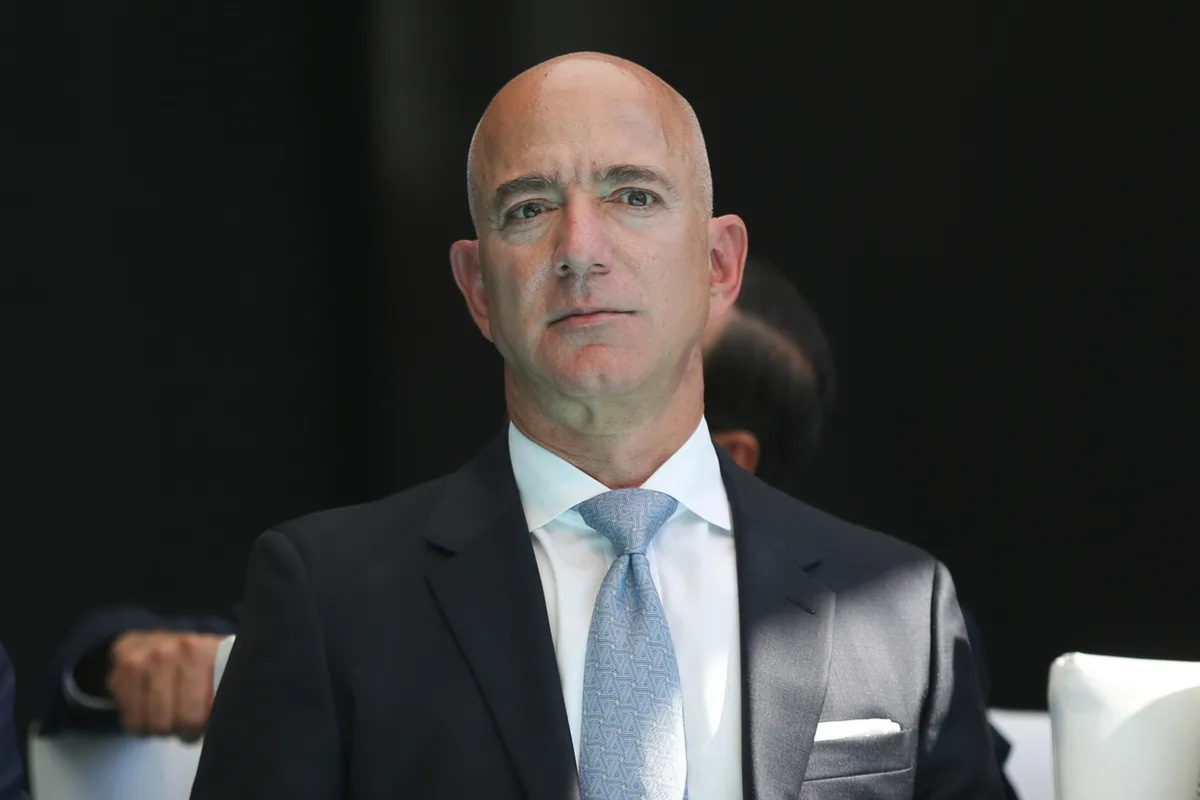

Amazon founder and executive chair Jeff Bezos plans to sell around $5 billion worth of Amazon shares after the e-commerce giant’s stocks hit a record high, a regulatory filing showed.

After market hours on Tuesday, the 25 million share sale was disclosed in a notice after Amazon stock hit a record high of $200.43 per share during the session.

The company’s stocks have increased over 30 percent so far this year on expectations that growing demand for artificial intelligence (AI) technology will boost earnings at its cloud computing business. The shares outpaced the 4 percent increase in the Dow Jones Industrial Average index.

Today, Amazon shares have declined 1.21 percent to $197.59, as of 8:16 GMT.

After the sale plan, Bezos would hold around 912 million Amazon shares or 8.8 percent of the outstanding stock. In February, Bezos sold around $8.5 billion of his shares in Amazon after the stock surged by 80 percent in 2023. This marked the first time since 2021 that Bezos had sold Amazon shares.

Last month, Amazon’s stock market valuation topped the $2 trillion mark for the first time. However, Amazon is still behind other major technology firms Nvidia, Apple and Microsoft, all of which have crossed the $3 trillion mark.

Read: Amazon invests $10.75 billion in Germany to expand cloud and logistics services

According to Forbes, Jeff Bezos is the world’s second-richest person with a net worth of $214.4 billion. Moreover, he is the founder of Blue Origin, a space company that launched a six-person crew to the edge of space in May.

For more technology news, click here.