The economy in Japan grew in the July-September period at a quicker rate than previously reported, driven by upward adjustments in capital investment and exports. This development has sustained market hopes for a potential interest rate increase by the central bank in the near future. However, a downward revision in consumption highlights the delicate nature of the economic recovery, casting doubt on how soon the central bank might raise interest rates again. Some analysts suggest that a hike in December is not assured.

The upcoming data will be among the key elements the Bank of Japan (BOJ) will examine at its next policy meeting scheduled for December 18-19, where some analysts anticipate an increase in short-term interest rates from the current level of 0.25 percent.

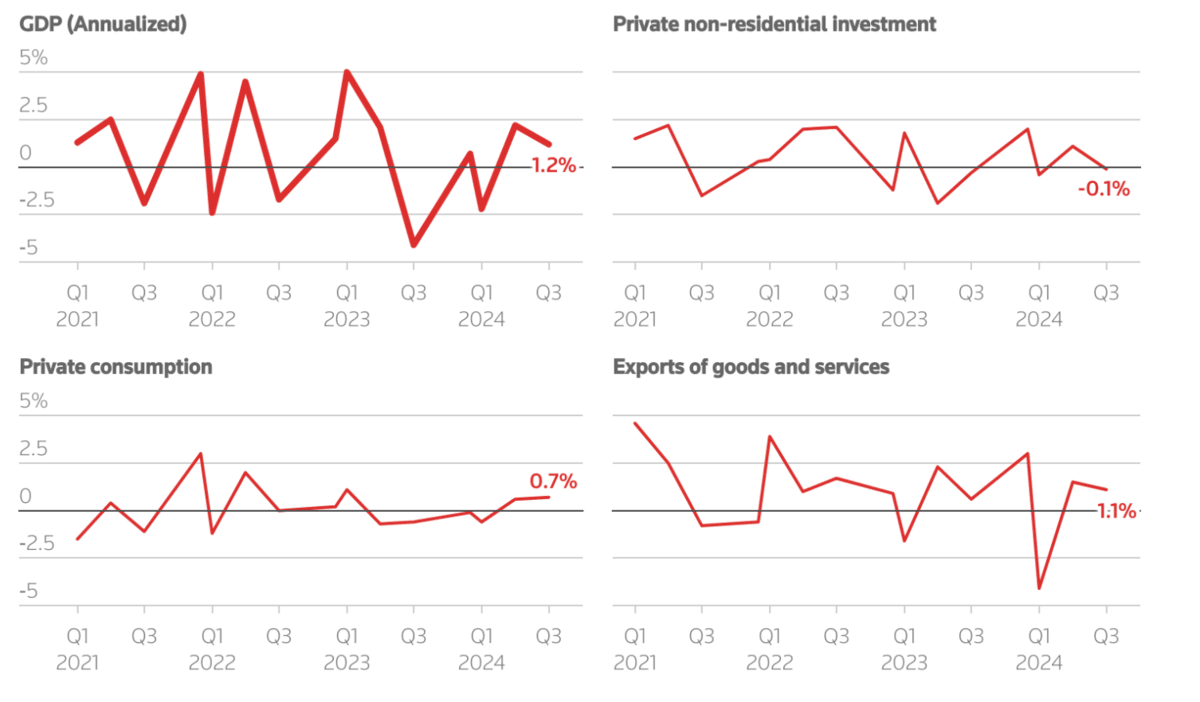

According to revised figures from the Cabinet Office, gross domestic product (GDP) increased at an annualized rate of 1.2 percent in the three months leading to September, surpassing economists’ median predictions and the initial estimate of 0.9 percent growth.

These adjusted figures indicate a quarter-on-quarter expansion of 0.3 percent in price-adjusted terms, an improvement over the preliminary growth of 0.2 percent reported on November 15.

The upward revision was partly due to a smaller-than-expected decline in capital expenditure, which decreased by 0.1 percent in the third quarter, compared to an earlier estimate of a 0.2 percent drop. This outcome contrasts with economists’ forecasts of a 0.1 percent increase.

External demand impact

External demand, calculated as exports minus imports, contributed negatively by 0.2 percentage points to growth, which is less than the 0.4 point decline in the preliminary data, according to the revised GDP figures. Private consumption, which makes up more than half of the Japanese economy, rose by 0.7 percent, falling short of the preliminary reading of 0.9 percent growth.

Comparison to previous quarters

Despite the upward revision, the third-quarter GDP growth remains significantly slower than the annualized growth rate of 2.2 percent recorded in the April-June period, which was primarily a rebound from a contraction in the first quarter linked to production disruptions in various auto plants.

Central bank’s policy shift

In March, the BOJ began to taper a radical stimulus policy that had been in place for a decade, and in July, it raised short-term interest rates to 0.25 percent, believing Japan was making strides toward sustainably achieving its 2 percent inflation target.

Future rate hike expectations

Governor Kazuo Ueda has indicated a willingness to increase rates again if the BOJ becomes more confident that inflation will consistently hover around 2 percent, supported by rising wages and strong domestic demand. Many market participants anticipate another rate hike by the end of the current fiscal year in March, although opinions are split on whether this will occur in December or early next year.

Cautious outlook ahead

The BOJ is approaching the timing of its next rate increase with caution, as December is far from a certainty given the weak consumption data, the governor’s careful decision-making approach, and concerns surrounding U.S. economic policy amid a potential second Trump presidency, as reported by sources to Reuters.

For more economy news, click here.