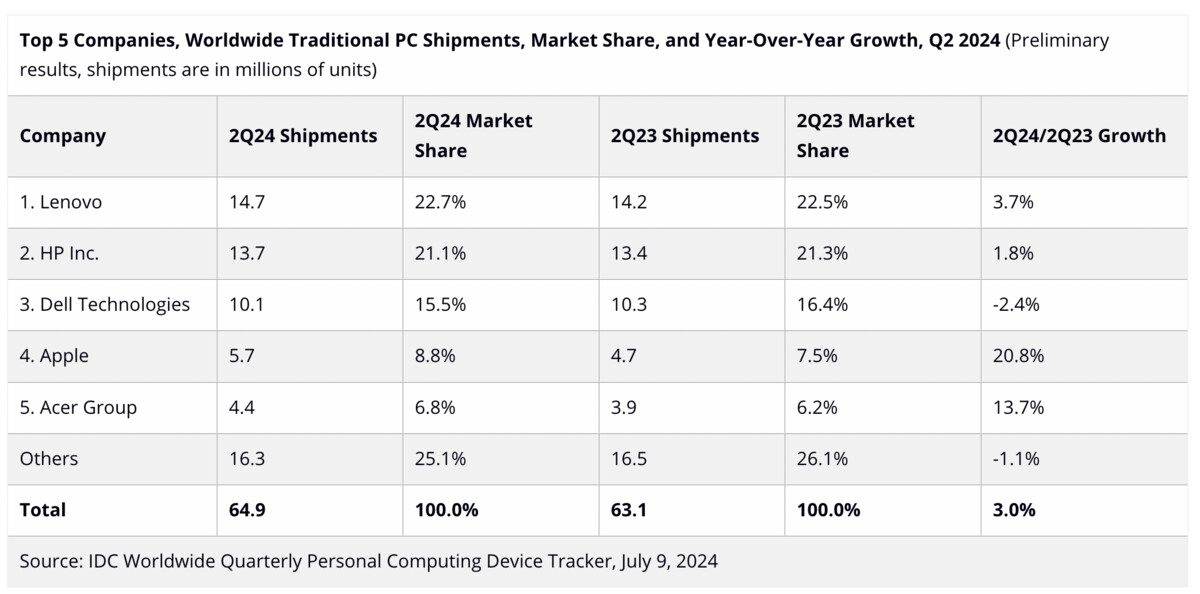

Global personal computer (PC) shipments rose by 3 percent in the second quarter of 2024 amid the rise in demand for artificial intelligence (AI)-capable devices. Preliminary data from research firm IDC recently revealed that Apple saw the largest growth in shipments among PC makers. Global PC shipments rose to 64.9 million in Q2, marking the second consecutive quarterly growth after two years of decline. However, weak results in China continued to hold the market back. Excluding China, worldwide PC shipments grew more than 5 percent annually.

Apple shipments surge

“Make no mistake, the PC market just like other technology markets faces challenges in the near term due to maturity and headwinds,” said Ryan Reith, group vice president with IDC’s Worldwide Device Trackers. “The buzz is clearly around AI, but a lot is happening with non-AI PC purchasing to make this mature market show signs of positivity,” he added.

In recent months, most of the industry players have launched their strategies for AI PCs focusing primarily on the component side and the potential of the commercial market. The IDC states that all eyes are on Apple to drive that message later this year with anticipated product launches. However, it shouldn’t be overlooked that Qualcomm, Intel and AMD are all likely to make noise around both consumer and commercial AI PCs.

Read: Jeff Bezos plans $5 billion Amazon share sale after stock hits record high

Promotional activity boosts growth

“Outside the commercial refresh cycle, promotional activity from consumer-oriented brands and channels have helped bolster the segment,” said Jitesh Ubrani, research manager with IDC’s Worldwide Mobile Device Trackers. “The market has also moved past the rock bottom pricing brought about by excess inventory last year, signifying growth in average selling prices due to richer configurations and reduced discounting,” he added.

For more technology news, click here.