Global economic growth is turning the corner as growth remained resilient through the first half of 2024, with declining inflation, though significant risks remain, according to the OECD’s latest Interim Economic Outlook.

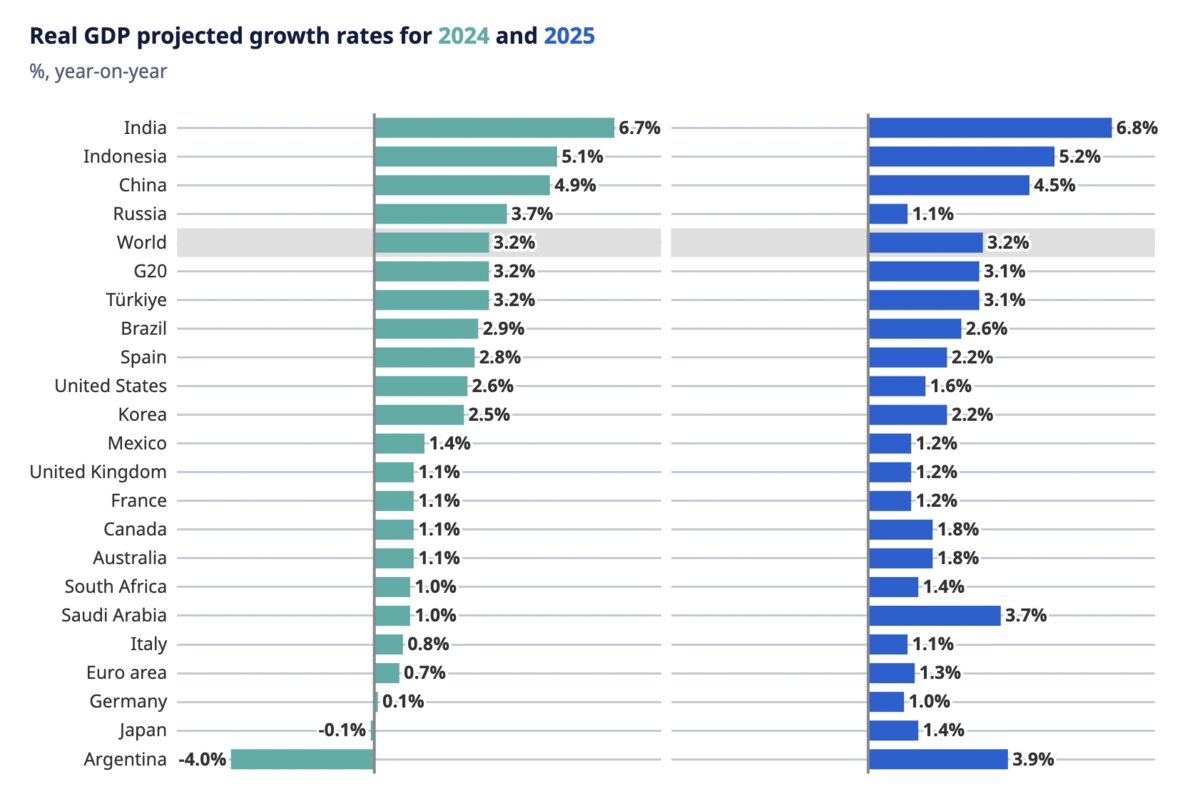

The first half of 2024 witnessed robust growth in trade, improvements in real incomes, and a more accommodative monetary policy in many economies. Therefore, the Organization for Economic Cooperation and Development’s outlook projects global growth to stabilize at 3.2 percent in 2024 and 2025, after recording 3.1 percent in 2023.

Inflation to decline back to target

The OECD’s latest report expects inflation to return to central bank targets in most G20 economies by the end of 2025. Headline inflation in the G20 economies will likely ease to 5.4 percent in 2024 and 3.3 percent in 2025, down from 6.1 percent in 2023. Meanwhile, core inflation in the G20 advanced economies should ease to 2.7 percent in 2024 and 2.1 percent in 2025.

“Declining inflation provides room for an easing of interest rates, though monetary policy should remain prudent until inflation has returned to central bank targets,” stated OECD secretary-general Mathias Cormann.

U.S. economy to slow

Amid the projected rise in global economic growth, GDP growth in the United States will likely slow from its recent rapid pace but remain strong due to recent monetary policy easing. The OECD expects growth in the U.S. to reach 2.6 percent in 2024 and 1.6 percent in 2025.

In the euro area, growth will likely reach 0.7 percent in 2024, before picking up to 1.3 percent in 2025, with activity supported by the recovery in real incomes and improvements in credit availability.

However, China’s growth is expected to ease to 4.9 percent in 2024 and 4.5 percent in 2025, with policy stimulus offset by subdued consumer demand and the ongoing deep correction in the real estate sector.

“To raise medium-term growth prospects, we need to reinvigorate the pace of structural reforms, including through pro-competition policies, for example by reducing regulatory barriers in services and network sectors,” added Cormann.

Key challenges remain

Global economic growth still faces some key challenges including the potential impact of a tight monetary policy on demand, while deviations from the smooth disinflation path could trigger disruptions in financial markets.

In addition, persisting geopolitical and trade tensions, including the Russia-Ukraine war and evolving conflicts in the Middle East, risk pushing up inflation again and weighing on global economic growth.

“The pace of regulatory reforms in recent years has been stalling, and in important parts of the economy, reform progress came to a standstill,” stated OECD chief economist Álvaro Santos Pereira.

On a positive note, real wage growth could provide a stronger boost to consumer confidence and spending, and further weakness in global oil prices would accelerate disinflation, further supporting global economic growth.

Read: U.S. home prices rise slightly in July 2024 amid slowing momentum, improving supply conditions

Rebuilding fiscal space remains key

As inflation moderates and labor market pressures ease further, monetary policy rate cuts should continue, even though the timing and the scope of reductions will need to be data-dependent and carefully judged to ensure inflationary pressures are durably contained.

“Amid sluggish productivity growth and tight fiscal space, product market reforms that promote open markets with healthy competitive dynamics remain a key lever to reinvigorate growth,” added Pereira.

With high public debt ratios, rebuilding fiscal space is key to be able to react to future shocks and future spending pressures, including from population aging and investments in digital transformation and the climate transition. Fiscal policy needs to focus on containing spending growth and optimizing revenues, while credible medium-term adjustment paths would help stabilize debt burdens.

For more economy news, click here.